KYC.LEGAL

KYC.LEGAL

KYC.Legal creates a tool that enables users to verify identity and service providers remotely and unobstructedly, to receive necessary supporting data in accordance with KYC requirements.

Going forward, KYC.LEGAL and related technologies will be part of the world's verification standards, providing a reliable, secure and effective solution for complex user verification tasks.

Services that enable user verification and prevent fraud. Blocking technology is the basic service as a tool to protect and verify the authenticity of personal data of network users.

To improve efficiency for all participants, the user verification process requires new platforms and exchange units. The platform implies the deployment of an automated set of services based on a decentralized blocking technology.

They Have Two Types Of Service

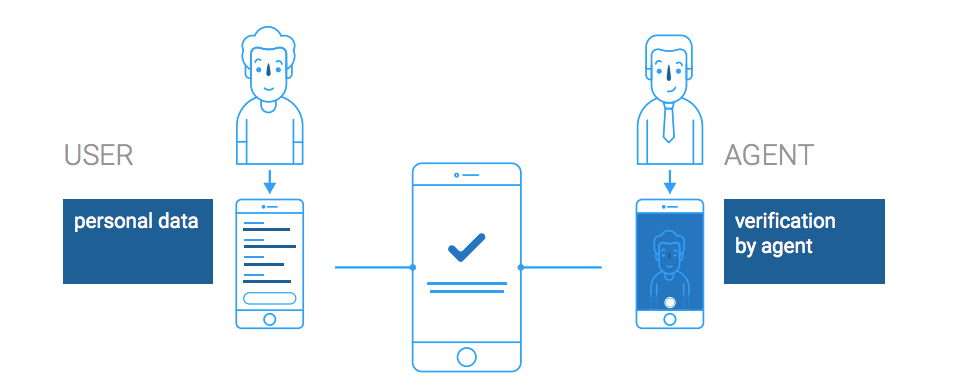

Personal identification services and verification services required by the agent.

Self-identification, or self-verification of personal data: KYC.LEGAL allows users to verify data provided by a simple code generation process to verify the user's identity.

Verification through certified agents: in most cases, KYC verification requires a third party certified agent to confirm the identity of the user. KYC.LEGAL solves this problem by creating a global network of trusted licensed agents (by 2020 working in the 20 largest metropolitan areas), ready to provide on-demand verification within 30 minutes of your request, to where you are.

Complex Services Currently Under Development Include:

Digital signatures and document verification: verified users have the right to verify documents and verify correctness of documents by other users.

Third-party services: the KYC.LEGAL ecosystem allows trusted third parties to provide verification signature and digital signature services.

The etereum platform is used for the operation of mobile payment systems, distributed exchanges, fiat-related tokens and fiat currencies, self-regulating market mechanisms, micro payment systems for distributed computing resources, commodity exchanges and stock exchanges, for crows and verification of legal documents.

Big companies are investing in Ethereal and using it, among the major early users are JP Morgan, Deloitte, IBM, Santand-er Bank, Microsoft, Luxembourg Stock Exchange and Royal Bank of Scotland.

Access To Database Can Be Provided With Three Different Ways:

1. Direct care. A direct appeal to Smart's contract at Solidi-ty. With our Smart Contract interface, you can interact either through a server or app, or directly. (for example, you can check other users or view the verifier list).

2. Access via API server. Services may communicate with system users through the API to check their users through KYC. The API provides a QR-code service that allows you to request personal data from the service and identify them.

3. Mobile app. The mobile app communicates with the database via an API server.This method is used when interacting with the system as primary and available to all users.

Mobile

Applications User registration in KYC applications

Users download KYC apps from AppStore or Google Play.

The step-by-step registration process takes place: it includes a name, surname, gender, age in the appropriate field.

Adding passport data

The video accuracy is confirmed by the following algorithm: the user starts recording, at this time a unique code is created, stored in a chain block and sent to the user. This code must be recorded during video recording.

Hash from video data is sent to the locker and stored in the contract.

User identification confirmed by authorized agent, verifier. Verifiers are not assigned manually to each user, but are determined by the administrator as a legal entity or an individual who has been given the right to verify different users. The verifier list will be available to users via mobile apps, and users will be able to select through which verifier is checked.

ICO KYC

There is a total stock of 42 million KYC tokens. 80% of these tokens go to ICO, 15% to the KYC team and 5% for operational costs. The maximum size for ICO is 35 million US dollars. The KYC mark is a sign of ERC20 and they are building a network of blocks of Ethereal. The token level is: 1 US dollar = 1 KYC.

ICO was launched on 1 December and will continue until March 1st or end earlier if HardCap has been updated, which is 35mln $.

TIM Street Map

KYC.legal Summary

In the US.legal document mentioned that 100,000 users attempt to open accounts in services that require a daily KYC check. All of these users rely on the KYC verification process, but there is currently no simplified global KYC process. That's what KYC is looking for.

KYC.legal aims to create a blockchain-based solution to today's problems. By using, KYC.legal, all customers can download their information through the app, view this information and then easily share this information with any platform.

Overall, KYC.legal has great potential to achieve something new for small businesses. The team is able to combine all the tasks necessary to succeed. Buy a token today and be a partner of the new revolutionary blockchain, the future cryptomeria leader.

For More Information, Click On Links:

-------------------------------------------------------------------------------------------------------------------------

My Bitcointalk Profile : Eslilin667

ETH Address : 0x8BF5F2559AeAe3f5CBf48cD6994A3fDb9B2Bc0a8

Komentar

Posting Komentar